No Spend Challenge PDFs⁚ A Comprehensive Guide

This guide explores various printable no-spend challenge trackers, offering different durations (weekly, monthly, yearly) to suit your needs. Downloadable PDFs provide structured tracking sheets to monitor spending habits, aiding in budgeting and financial goal achievement. Free resources are available to support your savings journey.

What is a No Spend Challenge?

A no-spend challenge is a self-imposed period where you consciously restrict non-essential spending. The duration varies, from a single day to a full year, with popular choices including 30-day or 31-day challenges. The core principle involves abstaining from discretionary purchases, focusing only on essential expenses like rent, utilities, groceries, and necessary transportation. This deliberate restriction aims to cultivate mindful spending habits, increase savings, and improve financial awareness; Participants often track their progress using printable trackers or budgeting apps, visually representing their success in curbing unnecessary spending. The challenge is not about deprivation but a strategic exercise in financial control and goal setting, ultimately leading to better financial management and increased savings.

Benefits of a No Spend Challenge

Embarking on a no-spend challenge yields numerous financial and psychological advantages. Firstly, it significantly boosts savings by eliminating impulsive purchases and unnecessary spending. This accumulated savings can be directed towards debt reduction, emergency funds, or significant investments. Beyond the monetary benefits, the challenge fosters mindful spending habits, promoting a greater awareness of daily expenses and financial priorities. Participants gain a clearer understanding of their spending patterns, identifying areas for future budget adjustments. This increased self-awareness extends beyond finances, encouraging greater discipline and self-control in other life aspects. Furthermore, the challenge can alleviate financial stress and anxiety by providing a sense of control over personal finances. Successfully completing a no-spend period instills a sense of accomplishment and boosts confidence in managing money effectively. The overall outcome is a more financially secure and empowered individual.

Types of No Spend Challenge PDFs

The diverse range of available no-spend challenge PDFs caters to various time commitments and individual preferences. Short-term options include weekly and monthly trackers, ideal for beginners or those aiming for quick financial wins. These typically offer simple layouts to record daily expenses and track progress. Longer-term PDFs, spanning 30, 31 days, or even a full year, provide a more comprehensive overview of spending habits. These often incorporate additional features like goal setting sections, expense categorization, and space for reflection. Some PDFs offer specialized trackers, focusing on specific spending categories like eating out or entertainment. Others integrate motivational elements, such as progress bars or celebratory milestones, to maintain engagement throughout the challenge. The variety ensures a suitable tracker for any individual’s needs and goals, fostering a personalized and effective approach to financial management. Choosing the right PDF is crucial for success.

30-Day No Spend Challenge Printable

A 30-day no-spend challenge printable offers a structured approach to curbing unnecessary expenses for a month. Many free and readily available templates provide daily tracking spaces, allowing you to monitor your spending meticulously. These printables often include sections for essential expenses, distinguishing them from non-essential purchases. This helps visualize spending patterns and highlight areas for potential savings. Some 30-day trackers incorporate motivational elements like progress charts or goal-setting sections. The visual representation of progress can enhance accountability and bolster motivation throughout the challenge. A well-designed 30-day printable can serve as a powerful tool for building better financial habits and achieving savings goals. The readily available resources allow for easy implementation, making it an accessible starting point for anyone seeking improved financial control. Remember to adjust the tracker to fit your specific needs and goals for optimal results.

31-Day No Spend Challenge Printable

Extending the commitment by a day, a 31-day no-spend challenge printable caters to months with an extra day, offering a comprehensive tracking system for the entire month. These printables mirror the functionality of 30-day trackers but accommodate the variation in monthly lengths. The additional day allows for a more accurate reflection of monthly spending habits, especially for those who prefer aligning their challenges with calendar months. Similar to 30-day versions, 31-day printables often include sections for essential expenses and non-essential spending, fostering a clear distinction between necessary and discretionary outlays. The visual representation aids in identifying spending patterns and areas for potential savings. Some 31-day trackers might incorporate motivational elements like progress bars or celebratory sections for marking milestones, enhancing user engagement. The availability of free printable options makes this extended challenge easily accessible, encouraging sustained financial discipline and mindful spending.

Weekly No Spend Challenge Printable

A weekly no-spend challenge printable offers a shorter-term, manageable approach to curbing spending habits. Designed for those new to financial challenges or seeking a less daunting commitment, it provides a focused, seven-day tracking period. The concise format allows for quick daily updates, fostering consistent monitoring of expenses. Unlike longer-duration printables, the weekly version emphasizes immediate feedback and adjustments, making it ideal for building good financial habits gradually. Users can easily identify daily spending patterns and make necessary modifications mid-week. Many weekly printables include space for noting planned spending, helping to avoid impulsive purchases. This targeted approach enhances self-awareness regarding daily spending triggers, empowering individuals to make more conscious financial choices. The brevity of the challenge makes it less overwhelming, encouraging consistent participation and promoting a sense of accomplishment upon completion. Free printable options are readily available online, making this a highly accessible starting point for individuals aiming to improve their financial management.

Monthly No Spend Challenge Printable

A monthly no-spend challenge printable provides a comprehensive overview of spending habits over a 30- or 31-day period. This extended timeframe allows for a more in-depth analysis of spending patterns, revealing recurring expenses and areas for potential savings. The detailed tracking sheet encourages a holistic view of monthly finances, encompassing various spending categories. Unlike weekly trackers, the monthly version offers a broader perspective, facilitating identification of larger financial trends. Many printable options include sections for essential expenses (like groceries and utilities) and non-essential spending (entertainment, shopping), promoting a clear distinction between needs and wants. This visual representation can be highly effective in highlighting areas where budget adjustments are most needed. The monthly format is suitable for those seeking a more significant financial impact, enabling them to track progress towards larger savings goals. Free downloadable versions are widely available online, offering diverse designs and features to suit individual preferences. Successful completion provides a strong sense of achievement and builds confidence in managing personal finances effectively.

Yearly No Spend Challenge Printable

Embark on a transformative financial journey with a yearly no-spend challenge printable. This comprehensive tracker provides a year-long overview of your spending habits, offering an unparalleled perspective on your financial behavior. Unlike shorter-term trackers, the yearly format allows for in-depth analysis of seasonal spending trends and the identification of long-term financial patterns. The detailed layout helps to establish consistent budgeting habits throughout the entire year, fostering improved financial discipline. The visual representation of your spending over 12 months provides a powerful tool for recognizing areas where significant savings can be achieved. The cumulative effect of tracking expenses over such an extended duration can be remarkably insightful, revealing hidden spending habits and opportunities for long-term financial growth. The yearly printable serves as a powerful motivational tool, encouraging consistent commitment to your financial goals. Moreover, the achievement of a successful year-long no-spend challenge instills a profound sense of accomplishment and reinforces your ability to manage finances effectively. Free printable versions are available, offering various designs to suit your preferences.

Essential Features of a No Spend Tracker PDF

A truly effective no-spend tracker PDF should incorporate several key features to maximize its utility. Clear and concise daily or weekly sections for recording expenses are paramount, allowing for easy input and analysis. Categorization options for expenses (e.g., groceries, entertainment, transportation) enable detailed tracking and identification of spending patterns. A designated space for noting planned exceptions or essential purchases ensures clarity and prevents frustration. Progress indicators, such as checkboxes or a visual representation of savings goals, provide motivation and a sense of accomplishment. The inclusion of a summary section at the end of the challenge period allows for a comprehensive review of spending habits and overall savings. A visually appealing design, incorporating color-coding or other aesthetic elements, enhances user engagement and motivates consistent use. The PDF should be easily printable, ensuring accessibility and convenience for users. Optional sections for setting financial goals and reflecting on progress further enhance the tracker’s effectiveness. Furthermore, readily available download links and clear instructions for use are essential for a positive user experience. Remember, a well-designed tracker serves as a powerful tool for achieving financial goals.

Tips for a Successful No Spend Challenge

Embarking on a no-spend challenge requires careful planning and a strategic approach. Begin by defining clear goals; what are you hoping to achieve? Debt reduction? Emergency fund creation? Setting realistic goals prevents discouragement. Before starting, meticulously plan your meals to minimize impulse grocery purchases. Identify potential temptations and develop strategies to avoid them. Consider utilizing a budgeting app or creating a detailed budget to monitor spending and ensure adherence. Share your goals with a friend or family member for added accountability and support. Remember that setbacks are normal; don’t let occasional slip-ups derail your progress. Focus on the positive aspects of saving money and the long-term benefits. Celebrate small victories along the way to maintain motivation. Review your spending patterns regularly to identify areas for improvement. Explore free or low-cost activities to avoid boredom and maintain engagement. Remember, consistency is key. Regularly check your no-spend tracker to visualize progress and stay motivated towards achieving your financial goals. Lastly, be kind to yourself and adjust the challenge as needed to ensure long-term success.

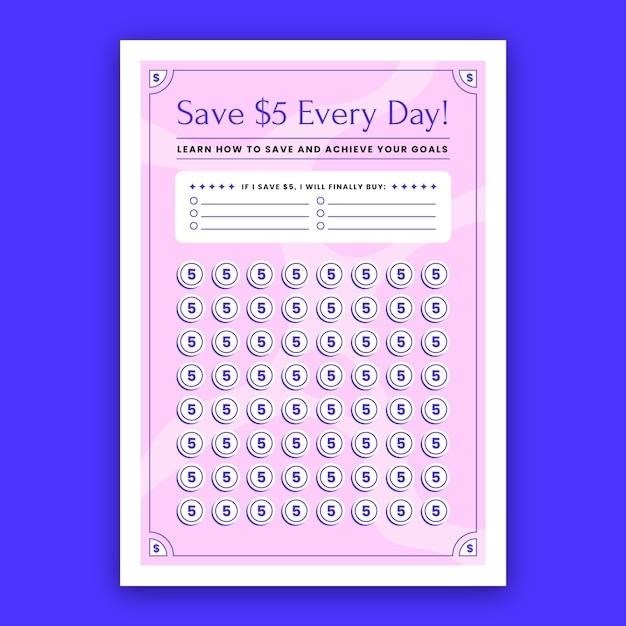

Free Printable No Spend Challenge Trackers

Numerous websites offer free printable no-spend challenge trackers in PDF format, providing a convenient and accessible tool for managing your financial goals. These trackers vary in design and functionality, catering to diverse preferences and needs. Some offer simple daily checkboxes to mark successful no-spend days, while others include sections for noting planned expenses or tracking savings progress. Many feature visually appealing designs with colorful themes, enhancing the overall experience and motivation. The availability of different durations—weekly, monthly, or yearly—ensures flexibility to suit individual challenge lengths. These free printables often incorporate additional features like expense categories, goal-setting sections, and motivational quotes, adding further value. Downloading these trackers is usually straightforward, often requiring a simple email sign-up or a direct download link. Remember to check the terms and conditions of the website before downloading. Printing these trackers on high-quality paper can enhance their usability and longevity. These free resources empower individuals to take control of their finances and achieve their savings goals without incurring additional costs.

Utilizing Apps for No Spend Tracking

While printable PDFs offer a tangible approach, numerous budgeting apps provide digital alternatives for tracking no-spend challenges. These apps often integrate with bank accounts and credit cards, automatically categorizing transactions and providing real-time insights into spending habits. Some popular options include Mint.com, Goodbudget, and You Need a Budget (YNAB). Mint.com offers a comprehensive overview of finances, automatically tracking expenses and enabling the setting of budget goals across various categories. Goodbudget uses the envelope budgeting system, allowing users to allocate funds to specific categories and monitor spending within those limits; YNAB employs a zero-based budgeting method, guiding users to allocate every dollar, promoting mindful spending and financial awareness. These apps often provide features like expense reports, goal-setting tools, and progress visualization, enhancing the tracking experience. While some apps offer free versions with limited functionality, premium subscriptions unlock additional features. The choice between a printable PDF tracker and a budgeting app depends on personal preference and technological comfort. Consider the features and functionalities of each option to determine the best fit for your no-spend challenge.

Overcoming Challenges During a No Spend Period

Successfully navigating a no-spend challenge requires proactive strategies for managing potential obstacles. The temptation to make unnecessary purchases can be significant; focusing on the long-term financial goals helps maintain motivation. Planning ahead and creating detailed shopping lists for essentials minimizes impulsive spending. Engaging in free or low-cost activities, such as spending time outdoors, pursuing hobbies, or socializing with friends, provides alternatives to retail therapy. If the challenge feels overwhelming, adjusting the rules or taking short breaks can prevent burnout. Maintaining open communication with family and friends about the challenge helps secure support and understanding. Tracking progress and celebrating milestones along the way boosts morale and reinforces commitment. Remember that setbacks are normal; learning from mistakes is key to long-term success. Reviewing spending patterns identified through the tracking process informs future budgeting strategies. Ultimately, adapting strategies and maintaining a positive mindset are essential for overcoming hurdles during a no-spend period.